LPL Acquiring Commonwealth: Opinions & Questions

In late March (2025), LPL Financial announced a deal to acquire Commonwealth Financial Network for $2.7 billion – a blockbuster transaction that has the potential to reshape the independent broker-dealer (IBD) landscape. The following article weaves together key points from three primary sources – LPL’s direct announcement, coverage by AdvisorHub, and an InvestmentNews article with a look behind-the-scenes. We’ll explore how each source frames the acquisition and provide an expert perspective on its potential impact, ask some important questions, and draw parallels to other major historical events.

LPL Financial’s Official Announcement

Article: LPL Financial to Acquire Commonwealth Financial Network

Source: LPL Financial Website

Date: March 31, 2025

The Facts ✅

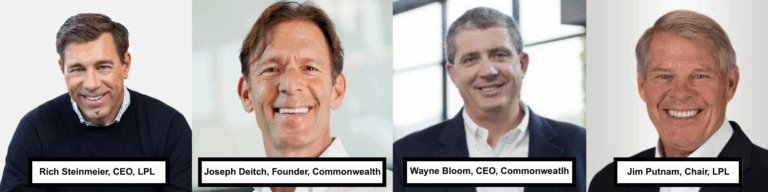

LPL’s own press release highlights Commonwealth’s scale – approximately 2,900 independent advisors managing $285 billion in assets – and notes the firm’s 11 consecutive #1 rankings for Independent Advisor Satisfaction, as awarded by J.D. Power. In this statement, LPL Chief Executive, Rich Steinmeier, emphasizes that Commonwealth’s culture “enhances the value” LPL brings to its growing network, describing how the two firms share a client-centric ethos. Meanwhile, Commonwealth founder Joseph Deitch says he’s sought a partner that remains advisor centric, advocates for advisor independence, and has a highly experienced team that will serve their advisors extraordinarily well for the long-term. Deitch will serve in an advisory role to LPL’s Board of Directors, and Commonwealth CEO Wayne Bloom is set to join LPL’s Management Committee.

Our Opinions 🧐

Taken at face value, LPL’s announcement reads like a marriage of two firms that believe deeply in advisor advocacy – they even propose an “Office of Advisor Advocacy,” presumably to ensure that Commonwealth’s hallmark boutique service experience doesn’t vanish in the transition. Historically, as large acquisitions in this industry unfold, the larger firm’s processes tend to inevitably shape (or even override) many of the smaller firm’s characteristics. With Commonwealth’s founder and CEO joining LPL in board and management roles and Bloom claiming, “Commonwealth will retain its brand as part of LPL”, there seems to be considerable confidence on both sides of the fence – at the executive level. However, at the advisor level, there seems to be some unrest, and there are some questions that need to be answered.

Our Questions ❓

Will LPL’s current scale ultimately standardize Commonwealth’s more customized approach? Commonwealth advisors will represent less than 10% of the total advisors at LPL – an integration of up to 2,900 advisors into a platform with 29,000 existing advisors. Despite the commitment to retaining Commonwealth’s culture, the numbers suggest that the task is a tall order.

What exactly did Bloom mean by “Commonwealth will retain its brand”? Did he mean that Commonwealth will keep all their branding and just be another arm of LPL’s business? “Commonwealth, powered by LPL”? Steinmeier’s own comments seems seem to contradict that, as he states that “Commonwealth’s service philosophy enhances the value we’ll bring to all advisors across the LPL network.” Which suggests that Commonwealth will integrate into LPL’s brand, and LPL will adopt and apply some of Commonwealth’s “qualities”? Maybe Bloom misspoke about the brand being retained and really meant that certain qualities from the brand would be retained.

Is the note about Commonwealth’s executives serving roles on LPL’s Board and Management Committee just smoke and mirrors? At first glance, it may seem like it’s a show of strength and good faith – meant to make Commonwealth advisors feel like their interests are being protected and advocated for. However, when the timeline is taken into consideration, it feels more like a magician’s sleight of hand – distracting the public to make it seem like the decision was not made on a whim.

AdvisorHub’s Perspective on Scale and Retention

The Facts ✅

AdvisorHub’s coverage underscores the raw numbers that make this acquisition so significant. The $2.7 billion deal is valued at a multiple of eight times Commonwealth’s $415 million in annual earnings. LPL, already supporting 29,000 brokers (with 15,000 affiliated in the traditional independent channel), stands to gain an additional 2,900 advisors – if it can retain them. According to the article, Commonwealth’s advisors typically oversee an average of $100 million AUM each (versus an average of $60 million at LPL), which suggests that Commonwealth advisors might be some of the higher-producing individuals within this newly combined future framework.

The article points out that LPL’s is aiming for a 90% retention rate among Commonwealth advisors and that they’re prepared to spend close to $485 million on onboarding and integration, with another $155 million in technology costs. It also addresses the fact that Commonwealth clears through Fidelity Investments’ National Financial Service (NFS), a fact that adds some complexity to the mix.

Notably absent from LPL’s announcement, but addressed by the AdvisorHub article, are any details about retention offers for Commonwealth advisors – an omission that presents a big question mark as to whether LPL plans to sweeten the deal to encourage advisors to stay. AdvisorHub notes that in prior acquisitions such retention packages are presented later, once the acquiring firm has had time to perform their due diligence on each advisor’s production and client base.

Our Opinions 🧐

With Commonwealth advisors averaging $40M AUM more than LPL advisors, but representing only 10% of the advisor base, the integration is facing a tricky imbalance from the start. Combined with an aggressive retention rate and a hefty, but vague, investment estimate, the numbers generate more questions than clarity.

With advisors facing the reality of eventually being forced off Fidelity’s clearing platform – one that’s been long prized for its third-party tech integrations – they may seek simpler alternatives than acquiescing to LPL’s environment. Ones that allow them to continue using Fidelity’s custody solutions. Rather than undertaking a massive repapering effort, advisors could join an existing RIA or other BD that utilizes Fidelity. By doing so, they could maintain far more of the technology and workflows they’re used to and minimize service disruptions to clients and support staff.

That possibility alone should give LPL pause and emphasize the importance of providing a clear and compelling path forward for advisors. Short-term incentives might entice some advisors, but if the underlying technology or culture changes too drastically, those same advisors could eventually still choose independence or alternative affiliations for the sake of continuity and client satisfaction.

Our Questions ❓

How did LPL come up with a 90% retention rate goal? To put it bluntly, 90% retention sounds aggressively over-confident in this situation. Especially, since that number didn’t come with any explanation or reason. On the surface, it again appears to be a statement made to instill confidence in the current Commonwealth advisor network. Upon further inspection, it seems to be another unsupported number that someone pulled out of a hat – leaving us to wonder what else LPL might be hiding up its sleeve.

What is being taken into consideration with the $485 million investment estimate? Is that a number calculated based on integration, repapering efforts, home office staff training? Or are those funds also being used for the incentive packages advisors may be presented with? If so, how will those packages be calculated, and will the offers come with contractual obligations?

The Behind-the-Scenes Origin Story

Article: “LPL purchase of Commonwealth started with CEO’s email”

Source: InvestmentNews

Date: April 1, 2025

The Facts ✅

Bruce Kelly’s InvestmentNews piece provides an inside look at how this deal originated. LPL CEO Rich Steinmeier reportedly sent Commonwealth founder Joe Deitch a friendly email around Christmas (December 2024 – less than 4 months ago), initially just to “get to know him.” Not to discuss any potential deals, but rather a “simple electronic hello”. They ended up on a Zoom call together later that day, where LPL’s chief apologized for the makeup he had smeared on his face, as the firm had just done new headshot photos of the executive team. Three months and fifteen Zoom calls later, the two hammered out a multi-billion-dollar deal. A statement alone that could be the punchline of a bad joke.

Steinmeier cites his admiration for Commonwealth’s “advisor-first” reputation, calling it “the apex in the industry” for service. Deitch, in turn, “immediately saw synergy,” culminating in a fully negotiated agreement where Deitch steps into an advisory role for LPL’s board. Additional notable quotes from LPL’s CEO were: “I wanted to learn the secret sauce”, “It felt like we fit together hand in glove; it was not one firm ingesting another”, “We intend to keep the Commonwealth community and service intact”, “I understand the financial advisors’ element of loving their community”, and “There is no other Commonwealth. So, we’re going to keep Commonwealth.”.

Our Opinions 🧐

The personal rapport between a large acquirer’s chief executive and a boutique firm’s founder can heavily influence how a transition is rolled out. If that relationship remains strong, it could result in significant efforts on LPL’s part to respect Commonwealth’s identity and adjust internal operations accordingly to preserve it. On the other hand, it’s clear that personal rapport was recently established and likely lacks any depth or trust. The two may have had a good laugh over some stage makeup, but the only reason Steinmeier was wearing makeup was because his new headshots had just been taken – because he’d been named CEO less than 3 months earlier.

A friendly foundation doesn’t guarantee the survival of a “boutique vibe” under a more standardized corporate umbrella – especially once a deal closes and the true work of both firms merging their day-to-day processes and procedures begins.

The last quote noted above, “There is no other Commonwealth. So, we’re going to keep Commonwealth.”, is another mention of retaining the Commonwealth brand. A recurring concept with equally recurring contradictions being made.

Our Questions ❓

Um, did I read that right? Two men had a conversation less than four months ago, and we’re talking about spending $485 million to retain 90% of advisors at a firm with a completely different culture and structure? No wonder we’re all confused about the specifics of the deal. How much due diligence can be done over 15 Zoom calls?

What is the actual strategy for implementing some of Commonwealth’s client service traits that make them “the apex in the industry”? How does a firm 10 times the size of their rival not only keep the culture of that acquired firm intact, but apply the desirable traits of that culture across its existing advisor base?

Should we be concerned about the players in this scenario? LPL CEO, Rich Steinmeier – CEO Since Mid-October 2024 (Interim CEO since October 1, 2024). Commonwealth Founder & Chairman, Joseph Deitch – Founded Commonwealth in 1979. Commonwealth CEO, Wayne Bloom – CEO since 2009 (will report to LPL CEO). LPL Chairman of the Board, Jim Putnam – chair since 2017 (mentioned in the article as holding Joseph Deitch in high regard). Credit to Steinmeier for making a blockbuster deal so quickly after being voted in as CEO. Only time will tell if his “electronic hello” becomes his legacy or his downfall.

Is History Doomed to Repeat Itself?

Echoes of Goldman Sachs & United Capital

A parallel being drawn is Goldman Sachs’ 2019 acquisition of United Capital. Initially, many United Capital advisors welcomed Goldman’s brand prestige and additional resources. It quickly became apparent, however, that some former United Capital advisors felt that the new structure conflicted with the autonomy and boutique relationships they’d enjoyed in the past. We cannot predict that LPL’s approach with Commonwealth is doomed to repeat history, but it does suggest a familiar pattern:

- Larger Firm Standardization: Over time, the acquirer’s technology platforms, compliance protocols, and marketing guidelines often start overshadowing the acquired firm’s prior setup – even if the initial messaging suggests otherwise.

- Culture Shift: Well-intentioned expansions (like new product lines or larger support teams) can inadvertently dilute small-firm dynamics if they’re not introduced with robust advisor input.

- Fit Reassessment: Those who thrived in Commonwealth’s more personalized environment could decide a different BD or a fully independent route serves them better if they perceive “too much corporate influence.”

Echoes of Charles Schwab and TD Ameritrade

We all remember some of the issues that came up in the Charles Schwab acquisition of TD Ameritrade (TDA). It wasn’t very long ago, and it affected a significant portion of the independent market in some way. Despite TDA having technology that many Schwab advisors were excited to gain access to, much of it was buried or made unrecognizable in the move. What was initially described as being a collaborative effort for a smooth integration felt much more like a forced implementation.

TDA experienced rounds of layoffs leading up to the conversion event – leaving advisors feeling unsupported and fearful of their future. On the other hand, Schwab initiated a mass hiring of low-level home office staff to prepare to meet the demands of the conversion. Schwab’s tiered service levels, implemented to ensure the best service goes where the most money is being managed, caused a lot of TDA advisors to be dealing with newly hired, quickly trained, and inexperienced staff during the process.

Again, there’s nothing to suggest that LPL will have any of the same issues that Schwab did, but there’s a reason there are so many famous quotes about historic recurrence – and a reason those quotes are so often referred to.

And What About the OSJ Model?

One thing not directly mentioned is LPL’s OSJ Model and how that would be applied to Commonwealth advisors – or if it would be. Herein lies a potential friction point. Advisors used to Commonwealth’s more “independent” structure could face new compliance or oversight layers. In other M&A scenarios, even small changes (like re-reporting trade data or adopting centralized marketing assets) may feel jarring to those who joined Commonwealth precisely for its advisor-friendly flexibility.

The OSJ structure has layers. Oversight authority is delegated, and the compliance burden is shared. Benefits of the model include back-office support, mentorship and community, business growth opportunities, and flexibility. However, the potential downsides of the OSJ model, and the considerations that need to be addressed as part of the deal, are revenue splits, autonomy and control, and overall fit. Not requiring or encouraging the OSJ model for Commonwealth advisors could cause tension amongst existing LPL advisors on the platform. However, forcing an OSJ model on advisors that didn’t choose it could be equally unfavorable.

One item that does seem to be confirmed by LPL, as referenced in this article, is that they’re prohibiting current OSJs from recruiting Commonwealth advisors. As Commonwealth was one of LPL’s closest competitors, this is essentially eliminating an entire pool of prospects.

Summary of Ways Commonwealth Advisors Could Be Affected

- Retention & Incentives – LPL hasn’t publicly detailed financial enticements, but advisors overseeing larger books may anticipate offers. However, even a generous retention deal can’t always offset the loss of an ecosystem they (and their clients) value.

- Custody Considerations – Commonwealth typically relies on Fidelity for clearing – a crucial element for many advisors. If LPL integrates them into their platform, repapering all accounts is a giant undertaking. Alternatively, advisors could sidestep that headache by joining an RIA or BD that also uses Fidelity, or a BD like Raymond James – making LPL’s path to 90% retention a pipe dream.

- OSJ Dynamics – Though not spelled out, industry whispers hint at possible tweaks to OSJ supervision. Even seemingly small changes in monthly reporting or compliance reviews can erode the freedoms advisors cherished under Commonwealth’s model.

- Client Perception – Clients accustomed to “Commonwealth’s personal approach” will notice if daily communications or statement formats shift to something more standardized. Advisors can maintain client confidence by communicating proactively about any real or rumored changes.

Final Thoughts & Next Steps

From official LPL press releases and InvestmentNews coverage to AdvisorHub insights, it’s clear that LPL is positioning the Commonwealth deal as a major scale-up in its quest to offer comprehensive advisor services. The million-dollar question is whether LPL can truly preserve Commonwealth’s revered culture in the long term.

For Commonwealth Advisors – especially those who joined the firm for its boutique ethos – it’s crucial to stay engaged with leadership, ask questions about potential changes, and decide if the new structure remains a good fit. It also can’t hurt to explore your other options.

For Recruiters and Existing RIAs – the announcement serves as an opportunity to have conversations with Commonwealth (and LPL) advisors who find themselves disenchanted with the proposed changes.

Choices We See Being Popular:

- Stick It Out (Commonwealth to LPL)

- Trust the process and the vision and go with the flow

- A question to ask: “Will I be required to switch clearing and when?”

- Switching IBDs

- Affiliate with another IBD that still utilizes Fidelity NFS for clearing

- Affiliate with another IBD that uses a different custodian/BD altogether

- Start an RIA

- Use the opportunity to make the full leap and do things the way you want

- Partner with Fidelity IWS to have Wealthscape familiarity

- Go with another custodian

- Build a multi-custodial arrangement

- A question to ask: “Can I handle the cost and responsibility?”

- Join an Existing RIA

- Join an RIA that already utilizes the Fidelity platform

- Join an RIA that is multi-custodial, so you have options

- Join an RIA that utilizes a completely different custodian

- Join an RIA that utilizes Raymond James as their custodian

- Opinion – Raymond James is the platform that most closely resembles the IBD space and is another direct competitor of LPL because of its plethora of available channels

Ultimately, the LPL acquisition of Commonwealth underscores a classic tension in the independent broker-dealer space: the allure of scale versus the desire for a personalized, small-firm environment. While initial statements paint a promising picture, so many questions need to be answered, and the real test begins once integration is underway. That’s when advisors’ experiences will either validate or contradict the optimistic press releases we’re speculating on.

If you’re a Commonwealth advisor with more questions than answers, and you want to talk to a trusted, confidential resource, reach out to us here. We’re more than happy to chat.

Sources Cited

- Article 1: LPL Financial Direct – LPL Financial to Acquire Commonwealth Financial Network

- Article 2: AdvisorHub, “LPL Inks $2.7B Deal for Commonwealth,” by Miriam Rozen and Mason Braswell

- Article 3: InvestmentNews, “LPL purchase of Commonwealth started with CEO’s email,” by Bruce Kelly

- Article 4: Citywire, “LPL to prohibit Commonwealth advisors from joining OSJs, affiliate enterprises” by Andrew Foerch